We help you get into the World's Best Business Schools

Our Students have a 300% Improvement in Acceptance Rates

We believe that numbers tell a compelling story. Our impressive track record as study abroad consultants is highlighted by our remarkable milestones. We take pride in our high number of successful admits, an enviable success rate, and numerous other significant achievements.

These figures are a testament to our unwavering commitment and expertise in guiding students on their international education journey.

Top B-Schools we've helped our students get into

As dedicated study abroad consultants, our goal is to get our students into the best business schools possible.

Their admits stand as a testament to our effective consultation services. Through personalised guidance and dedicated support, we've successfully assisted thousands of students in securing admissions to some of the world's most prestigious business schools.

Get Mentored By

The Best Study Abroad Consultants

For Business Degrees

Management

Finance

Business Analytics

Masters

Here is a Snapshot of our Success Run

As one of the world’s best study abroad consultants, we have guided countless students towards their dream international education. The numbers below are a small snapshot of the same. We believe in delivering results, and our track record is a clear demonstration of this commitment.

We have 3X higher admits in the Top 10 Schools as compared to any other

Study Abroad Consultancy.

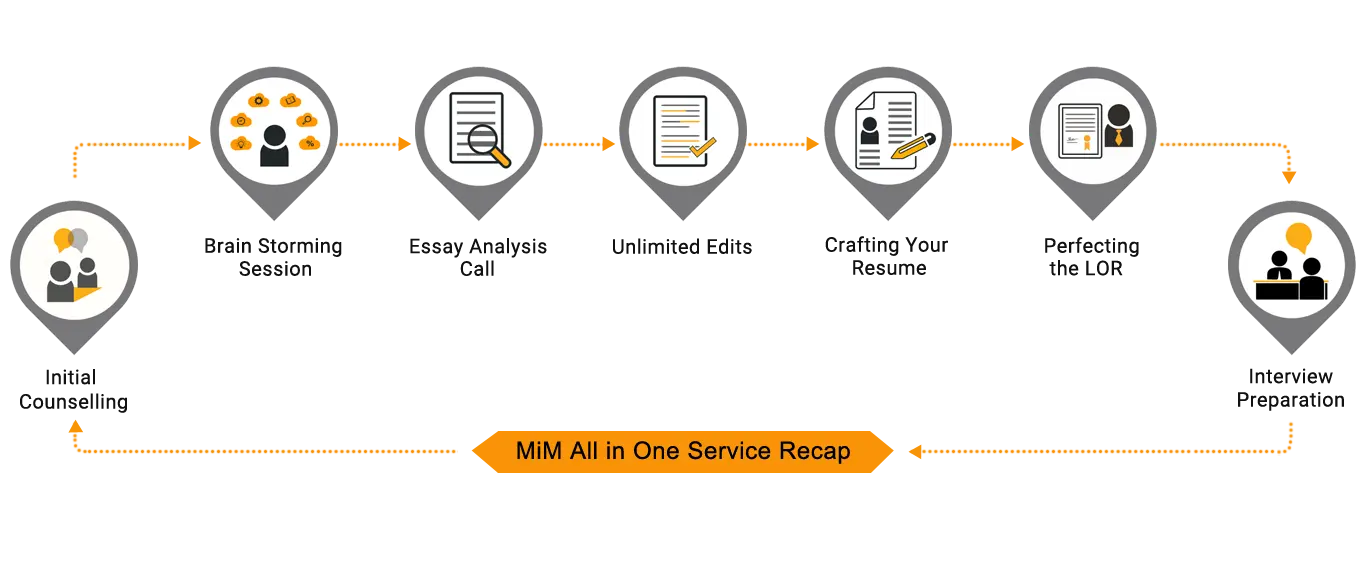

Our All-In-One Service is designed to help you create an application that differentiates you from 200,000+ Applicants

Here’s a glimpse of it

At MiM-Essay, we understand that applying for a prestigious business school can be a daunting task. With over 200,000 applicants vying for a spot in these coveted programs each year, how can you ensure your application stands out from the crowd?

That's where our All-In-One Service comes into play.

All-In-One is our signature service which has helped us bag the spot of one of the best study abroad consultants globally. Crafted with your unique journey in mind, our All-In-One Service is more than just an application aid - it's a comprehensive approach to showcase your individual strengths, talents, and experiences. We don't just help you fill out forms, but rather, we work closely with you to craft a compelling narrative that highlights your unique qualities and potential.

From providing expert guidance on structuring your essays to offering insights on how to shine during the interview, our team is committed to supporting you at each step of the application process.

Our Goal?

To help you build a standout application that resonates with admission committees and differentiates you from the sea of applicants.

What Makes us The Best Study Abroad Consultants?

In the cookie-cutter market of education consultants, how are we different? Here's the answer.

Wondering how we stand apart in the crowded field of study abroad consultancy? Our difference lies in our personalized approach, deep industry knowledge, and unwavering commitment to your success.

Unlike others, we don't believe in a one-size-fits-all strategy. Instead, we tailor our services to your unique needs and aspirations. Our team of experienced consultants stays abreast of the latest trends and opportunities in global education, ensuring you receive the most current and relevant advice.

We're not just your consultants; we're your partners in your journey to study abroad.

We have mentored applicants across 39 Nationalities

We're trusted by aspirants across 39 different nationalities, all with unique profiles, dreams and aspirations.

As one of the world’s best study abroad consultants, we have a proven understanding of different profiles across cultures and geographies.

Start off by scheduling a no-obligation, free call with us to embark on a successful international education journey.

70% of your chances for admission to leading business schools rely on four crucial elements of your Profile

Having consulted over 500,000 applicant profiles, we've decoded the factors that top business schools prioritise in their selection process.

Try our profile evaluation today, created by some of our best study abroad consultants, and see if your profile is ready for the world's premier schools.

When it comes to pursuing business degrees like MBA, MiM, MEM, MFin, or MBSA, choosing the right university can significantly impact your future career prospects. With numerous options available worldwide, it can be overwhelming to identify the best-fit schools for your aspirations. That's where a study abroad consultant comes in as your trusted guide and advisor.

MiM-Essay specializes in helping students navigate this complex landscape. We have in-depth knowledge of top universities offering business degrees and can assist you in exploring the finest institutions across the globe.

Management

Finance

Business Analytics

We Offer an Insurance on your Investment

Your satisfaction is our priority. Our refund policy ensures that your investment is protected and you get consulting services of the highest quality.

Click to read our refund policy.

Frequently Asked Questions(FAQs)

Hiring a study abroad consultant like MiM-Essay provides you with expert guidance and support throughout the entire application process. We have in-depth knowledge of various universities, programs, and admission requirements. We can help you make informed decisions, maximize your chances of acceptance, and provide valuable insights on scholarships, visa processes, and accomodation.

The difference is having an acceptance chance of 5% compared to that of 70%

Our Study abroad consultants have extensive experience and expertise in the field. Having already graduated from some of the worlds best schools, we will assess your academic background, career goals, preferences, and aspirations and accordingly provide personalized recommendations. We can help you explore a wide range of universities and programs, considering factors such as reputation, curriculum, faculty, location, and student support services, to help you make an informed decision.

Absolutely! our consultants are skilled at helping you craft compelling application essays and resumes that highlight your strengths, experiences, and aspirations. They will provide guidance on essay topics, structure, and content, ensuring that your application materials effectively showcase your unique qualities and stand out to admission committees.

A strong personalsied essay is the difference between and admit and a reject, regardless of your GMAT score.

Yes, We can provide valuable information and guidance on scholarships, grants, and financial aid opportunities. We can help you identify scholarships that align with your profile and assist you in preparing strong scholarship applications. We can also provide insights on alternative funding options, loan programs, and part-time job opportunities in your study destination.

About 40% of applicants working with us bag scholarships in some form or the other.

.png)

.webp)

.png)

.png)

.png)